Yet again the ‘Mighty Deutsche Bank’, takes ’1st place for an impressive 9th consecutive year (2013-05), in the 2013 EuroMoney FX Survey rankings.

Key findings:

- Deutsche take 1st place for 9th consecutive year, and for first time since 2008 reverses the fall in market share, with a 4.26% YoY rise to 15.18% (14.56% last year), compared to 21.7% in 2008.

- Citi continues to power ahead, with market share up 21.53% YoY to 14.90% (12.26% last year), compared to 7.49% in 2008 (see here for Citi Velocity post which is built on Caplin’s technology)

- Bank America Merrill Lynch (BAML) enter the top ten, up 2 places with a 27.80% YoY gain to 3.08% (2.41% last year)

- Eight of the top twelve banks see fall in market share YoY (lead by Credit Suisse, down to 3.7% from 4.68% last year, a near 21% YoY drop)

The EuroMoney survey is probably the most comprehensive and widely watched in the industry, and no doubt a number of bank e-commerce team bonuses and promotions (or relegation’s) are decided by achieving, defending or missing key ranking positions.

- Seven of the top twelve banks see rise in market share between 2013-07 (lead by Citi up 5.90% since 2007)

- Sberbank is the biggest riser up 32 places from 81 to 49th place, although market share is only 0.08%

- TD Securities is the biggest faller with a drop of 13 places from 23 to 36th place with market share of 0.21%

- JP Morgan maintain their 6th place, which is not bad considering they didn’t lobby clients to vote for them, although they did see an 8% YoY fall to 6.07% from 6.6% last year.

EuroMoney 2013 Top 12 FX Banks

Color indicates YoY growth, positive or negative

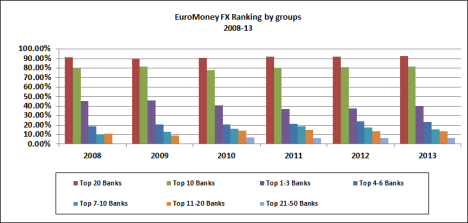

I have created some interesting charts based on the tables which are shown below.

Chart above showing changes in market share 2013-07. Citi is the biggest winner, whilst Deutsche and UBS are the biggest losers.

Chart above contrasts Deutsche and Citi, showing the dramatic rise in Citi’s FX market share. The contrast between Deutsche and Citi is seen even more dramatically when we look at the near doubling of Citi’s market share between 2008 and 2013, and the corresponding 30% fall in Deutsche’s share over the same period.

Chart above shows Cumulative share of the groups of banks is little changed over last year

Final table shows faster movers in terms of ranking position in the EuroMoney 2013 FX Survey. Leading the risers is Sberbank up 32 places from 81 to 49, although market share is still very small at a modest 0.08%, but moving in the right direction!

Full EuroMoney FX 2013 survey results available from EuroMoney here, and EuroMoney Press Release of results available here

Previous posts on EuroMoney 2012 FX survey here

Filed under: FX, Survey Results, Web trading technology |

[…] Kong clients, which makes sense when you look at BNP’s FX scorecard according to the latest EuroMoney FX survey, where they are particularly strong in both Corporates and […]

[…] Yet, despite this huge investment, the FX market share of the top five global banks has actually fallen by nearly 1% between 2008 and 2013 from 58.21% to 57.36%, with Deutsche being the biggest loser (down 6.52%) and Citi the biggest gainer (up 7.41%), as discussed in the EuroMoney 2013 FX polls. […]

[…] at the global FX market a little closer, and using the Euromoney 2013 FX polls as a guide, we can split the reporting dealer banks who are active in this market into three […]

[…] 9 years, Deutsche’s market share has been falling over that period according to data from the EuroMoney 2013 FX polls, as other bank’s up their game. So, it will be interesting to hear from Kevin how Deutsche […]

[…] a new record of $5,345bln/day. The global ‘FX flow monsters’ continue to dominate the EuroMoney 2013 FX Bank rankings with Deutsche Bank retaining pole position for an astonishing 9th consecutive […]

[…] EuroMoney 2013 FX Poll Results […]

[…] UBS is ranked #4 (behind #1 Deutsche, #2 Citi and #3 Barclays) according to latest EuroMoney 2013 FX survey. Although, their market share has fallen steadily from 14.85% in 2007 to 10.1% in 2013 (a 5% fall […]

[…] has been global #1 in FX for the past 9 years according to the latest EuroMoney 2013 FX Survey, although their market share has continued for fall over that period, so will be interesting to see […]

[…] of the more interesting statistics. Although when I look at the figures shown and compare them to my own data on the EuroMoney rankings, it seems to flag up some inconsistencies, which I will return to in a later post once I have […]

[…] The EuroMoney 2013 results are available here […]